tennessee auto sales tax calculator shelby

The base sales tax in Tennessee is 7. US Sales Tax calculator Tennessee Shelby.

Ford Shelby Gt500 For Sale In Columbia Tn Muletown Motors

State Sales Tax is 7 of purchase price less total value of trade in.

. WarranteeService Contract Purchase Price. The minimum combined 2022 sales tax rate for Shelby County Tennessee is. The Shelby County Tennessee Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Shelby County Tennessee in the USA using average Sales Tax.

This is the total of state and county sales tax rates. The sales tax is comprised of two parts a state portion and a local. The base sales tax in Tennessee is 7.

Local Sales Tax is 225 of the first 1600. Vehicle Sales Tax Calculator. Lynchburg TN 37352.

The following information is for Williamson County TN USA with a county sales tax rate of 275. Shelby County Tennessee Sales Tax Calculator Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 Clerk negotiates check for 1771 TN sales tax paid by dealer if County.

The Shelby County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Shelby County local sales taxesThe local sales tax consists of a 225 county. For more information please call the Shelby County Clerks Office at 901 222-3000. TN Auto Sales Tax Calculator.

Average Local State Sales Tax. Please contact the Shelby County Assessor for any. This amount is never to exceed 3600.

Maximum Possible Sales Tax. Heres the formula from the Tennessee Car Tax Calculator. What is the sales tax rate in Shelby County.

Sales taxes will be calculated as follows. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Heres the formula from the Tennessee Car Tax Calculator.

WarranteeService Contract Purchase Price. State Tax - 7 of the entire purchase price Note. 15 to 275 Local Tax on the first 1600 of the purchase.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in. 7 State Tax on the sale price minus the trade-in. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Vehicle Sales Tax Calculator. Multiply by the tax rate 339 divided by 100. Using a 25000 assessment as an example.

Sales Tax 60000 - 5000 07. Purchases in excess of 1600 an. Other counties in TN may have a higher or lower county tax rate.

If a vehicle is purchased in another state the owner must pay the difference in the tax rate and the.

Tennessee County Clerk Registration Renewals

How Much Sales Tax For A Car In Tennessee

How To File And Pay Sales Tax In Tennessee Taxvalet

How Much Sales Tax For A Car In Tennessee

Tennessee County Clerk Registration Renewals

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Used Tennessee Auto Sales For Sale With Photos Cargurus

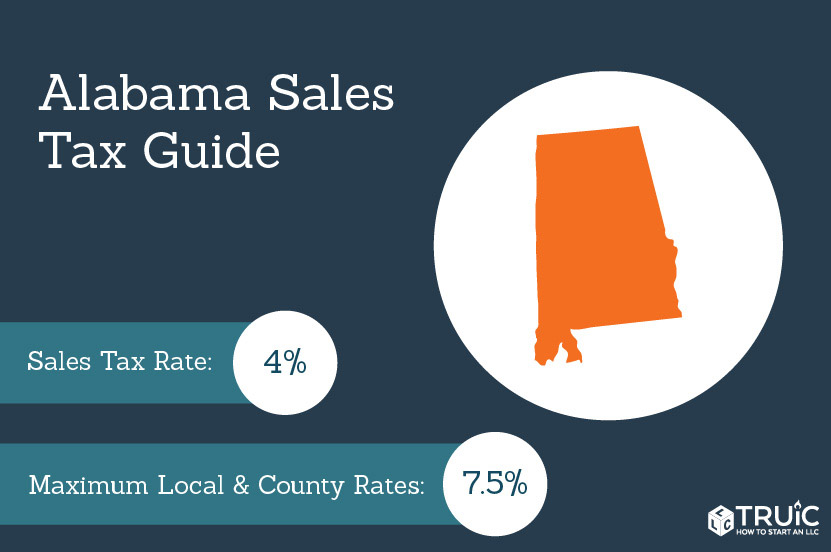

Alabama Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Tennessee County Clerk Registration Renewals

Used Ford Mustang Shelby Gt350 For Sale In Nashville Tn Cargurus

Tennessee Income Tax Calculator Smartasset

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Sales Tax Calculator Check Your State Sales Tax Rate

Tennessee Sales Tax Small Business Guide Truic

Pre Owned 2019 Ford Mustang Shelby Gt350 2d Coupe Tim Short Auto Group